World class lending platform

Available to license

Get your lending business up and running in weeks with the world's best lending platform.

Available to license

Get your lending business up and running in weeks with the world's best lending platform.

World's best lending platform

Build your lending business to scale with the world's best lending platform. We've of everything your business needs to grow from issuing one loan to issuing one million. Our robust platform has you covered and you can get started in just a few days.

Build your lending business to scale with the world's best lending platform. We've of everything your business needs to grow from issuing one loan to issuing one million. Our robust platform has you covered and you can get started in just a few days.

Onboarding

Give your clients a rich onboarding experience with a responsive design that's mobile friendly and simple to complete pages. Nothing is left in or out and it's just the right amount of information to ask for.

Underwrite

Choose the clients you want to lend to using credit classification or machine learning based on your credit criteria or past experience. Validate client identity quickly and efficiently.

Originate

Fund new loans quickly and easily with morning batch processing for EFT / ACH and real time transfers by Email Money Transfer. It will keep your clients happy and your loan book more active.

Maintain

Get the best platform with all functionality you can think of to service and maintain your clients in a quick and efficient manner. From updating client information to processing payments and more - it's all there.

Are you ready to become an lender with the best lending platform in the world?

Onboard clients quickly and easily

We make it easy to on board your clients with different products. The signup process is already customized depending on what your clients are looking for and you can customize it further quickly and easily by extending the predefined templates. It's all built in and ready to go when you are.

We make it easy to on board your clients with different products. The signup process is already customized depending on what your clients are looking for and you can customize it further quickly and easily by extending the predefined templates. It's all built in and ready to go when you are.

Fully compliant with regulations

Fully compliant with regulations

Initial interest and fees

Initial interest and fees

Single or split payments

Single or split payments

Optional loan conversion to term

Optional loan conversion to term

Small or large dollar loans

Small or large dollar loans

Selectable payment terms and schedule

Selectable payment terms and schedule

Add-on products such as insurance

Add-on products such as insurance

Preview repayment amounts

Preview repayment amounts

Term Loans for business operations

Term Loans for business operations

Merchant cash advance support

Merchant cash advance support

In-Store and Online Financing

In-Store and Online Financing

Purchase order financing

Purchase order financing

Underwrite loans using the most advanced technology

Make use of the best underwriting technology in the world to get better credit decisions built directly into the platform. We use optional bank scraping by default to give you a complete picture of a clients financial standing and identity. From there, further validate client identity using our unique video verification technology to reduce online fraud significantly. Combine this with an automated or after the application is complete credit check for the complete picture.

Make use of the best underwriting technology in the world to get better credit decisions built directly into the platform. We use optional bank scraping by default to give you a complete picture of a clients financial standing and identity. From there, further validate client identity using our unique video verification technology to reduce online fraud significantly. Combine this with an automated or after the application is complete credit check for the complete picture.

Bank Scraping Technology

Bank Scraping Technology

Verify income sources and payroll

Verify income sources and payroll

Validate contact and profile information

Validate contact and profile information

Credit checks from Transunion or Equifax

Credit checks from Transunion or Equifax

SMS or MMS Verification Steps

SMS or MMS Verification Steps

Geolocate clients in real-time

Geolocate clients in real-time

View Photo ID, Statements and more

View Photo ID, Statements and more

Validate using video verification

Validate using video verification

Pre-approve and Approve Clients

Pre-approve and Approve Clients

View applications in real-time

View applications in real-time

Make credit decisions quickly

Make credit decisions quickly

Resume and reset applications

Resume and reset applications

Originate loans quickly and easily with the click of a mouse

When application and approved loan volume is an issue you can originate loans quickly and easily automatically or with the click of a mouse for after the application is complete underwriting. Funds are sent to the client in near real time for Electronic Funds Transfer (EFT) and Automated Clearing House (ACH) transfers. For email money transfer (EMT) accounts the funds are sent instantly, keeping your clients happy.

When application and approved loan volume is an issue you can originate loans quickly and easily automatically or with the click of a mouse for after the application is complete underwriting. Funds are sent to the client in near real time for Electronic Funds Transfer (EFT) and Automated Clearing House (ACH) transfers. For email money transfer (EMT) accounts the funds are sent instantly, keeping your clients happy.

Deposit only into the account on file

Deposit only into the account on file

Same day processing in most cases

Same day processing in most cases

Secure and reliable way to send funds

Secure and reliable way to send funds

Verify the client name on the account

Verify the client name on the account

Instant deposit in most cases

Instant deposit in most cases

Refunds possible with online fraud

Refunds possible with online fraud

Send funds instantly

Send funds instantly

Validate card numbers online

Validate card numbers online

Convenient instant method of payout

Convenient instant method of payout

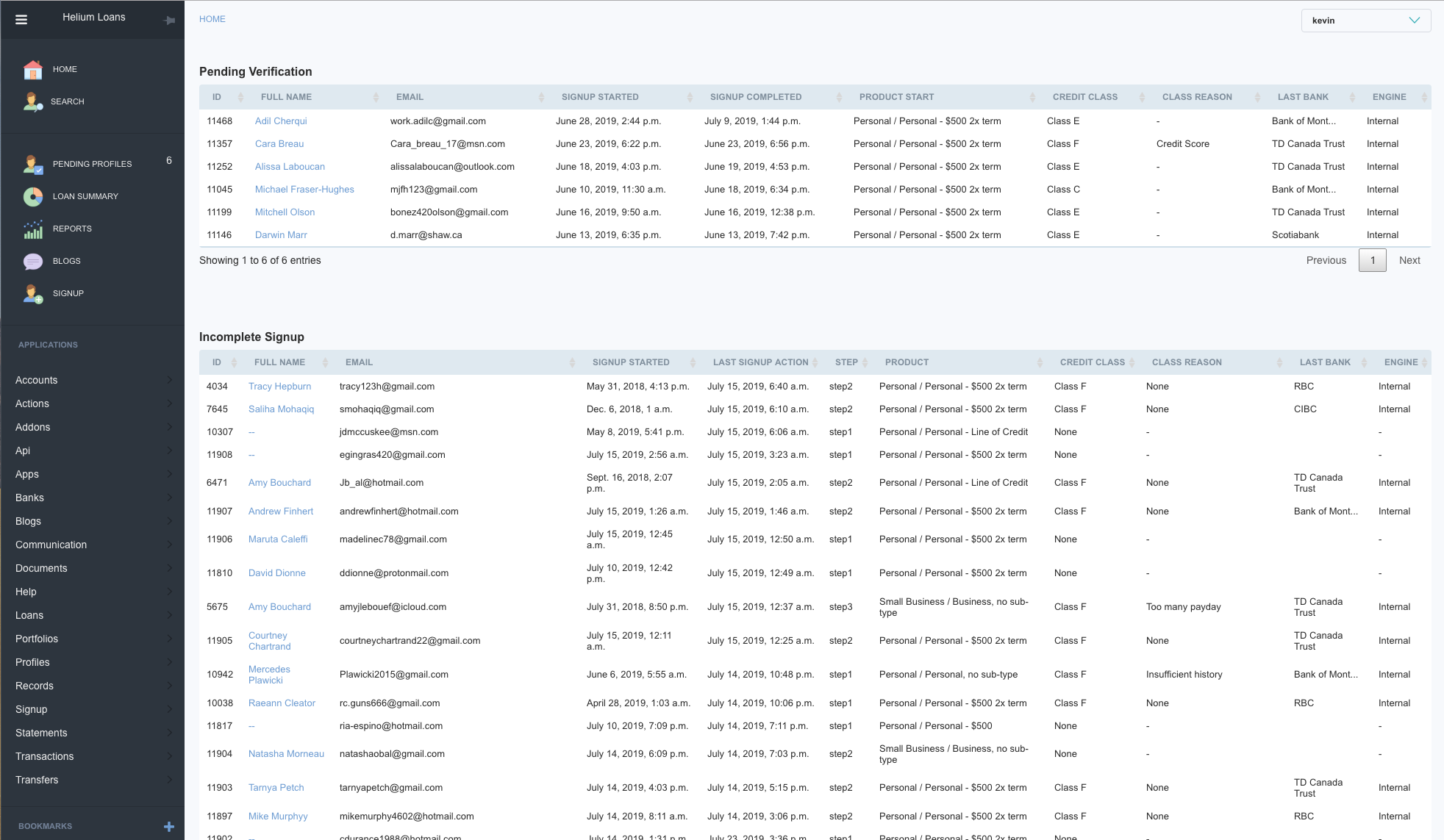

Maintain loans with the most powerful lending platform

Servicing and maintaining loans with our platform is incredibly simple and powerful. We have thought of everything and give you the power to maintain your loans as you see fit. Client lookups are instant and complete profile information is available at your finger tips. Send unpaid loans to collections where you can send out physical letters or litigate the client in court. Pre-defined templates make it easy.

Servicing and maintaining loans with our platform is incredibly simple and powerful. We have thought of everything and give you the power to maintain your loans as you see fit. Client lookups are instant and complete profile information is available at your finger tips. Send unpaid loans to collections where you can send out physical letters or litigate the client in court. Pre-defined templates make it easy.

Search by phone, name, email, address, etc...

Search by phone, name, email, address, etc...

View complete client information on one page

View complete client information on one page

Assign and view filtered data for each client

Assign and view filtered data for each client

All information is kept on file for the client

All information is kept on file for the client

Small or Large Dollar Loans

Small or Large Dollar Loans

Selectable payment terms and schedule

Selectable payment terms and schedule

Addon Products such as Insurance

Addon Products such as Insurance

Preview repayment amounts

Preview repayment amounts

Automatic reminders 7, 14 and 30 days past due

Automatic reminders 7, 14 and 30 days past due

Automated call, email and SMS reminders

Automated call, email and SMS reminders

Support for consumer proposals / bankruptcies

Support for consumer proposals / bankruptcies

Send physical complete letters

Send physical complete letters

Get the best lending platform

| Supported | Others |

|

|---|---|---|

| Responsive and complete client dashboard with easy to use interface |  Yes Yes |

|

| Customizable public pages and client dashboard with your brand logo and colours |  Yes Yes |

|

| In-store financing solution with branded tablets |  Yes Yes |

|

| In-store financing solution with branded tablets |  Yes Yes |

|

| Online financing solution with your logo and brand colours |  Yes Yes |

|

| View and sign documents electronically without the need any paper |  Yes Yes |

|

| KYC and AML compliance for countries that need it |  Yes Yes |

|

| Localization and multi-currency support built in |  Yes Yes |

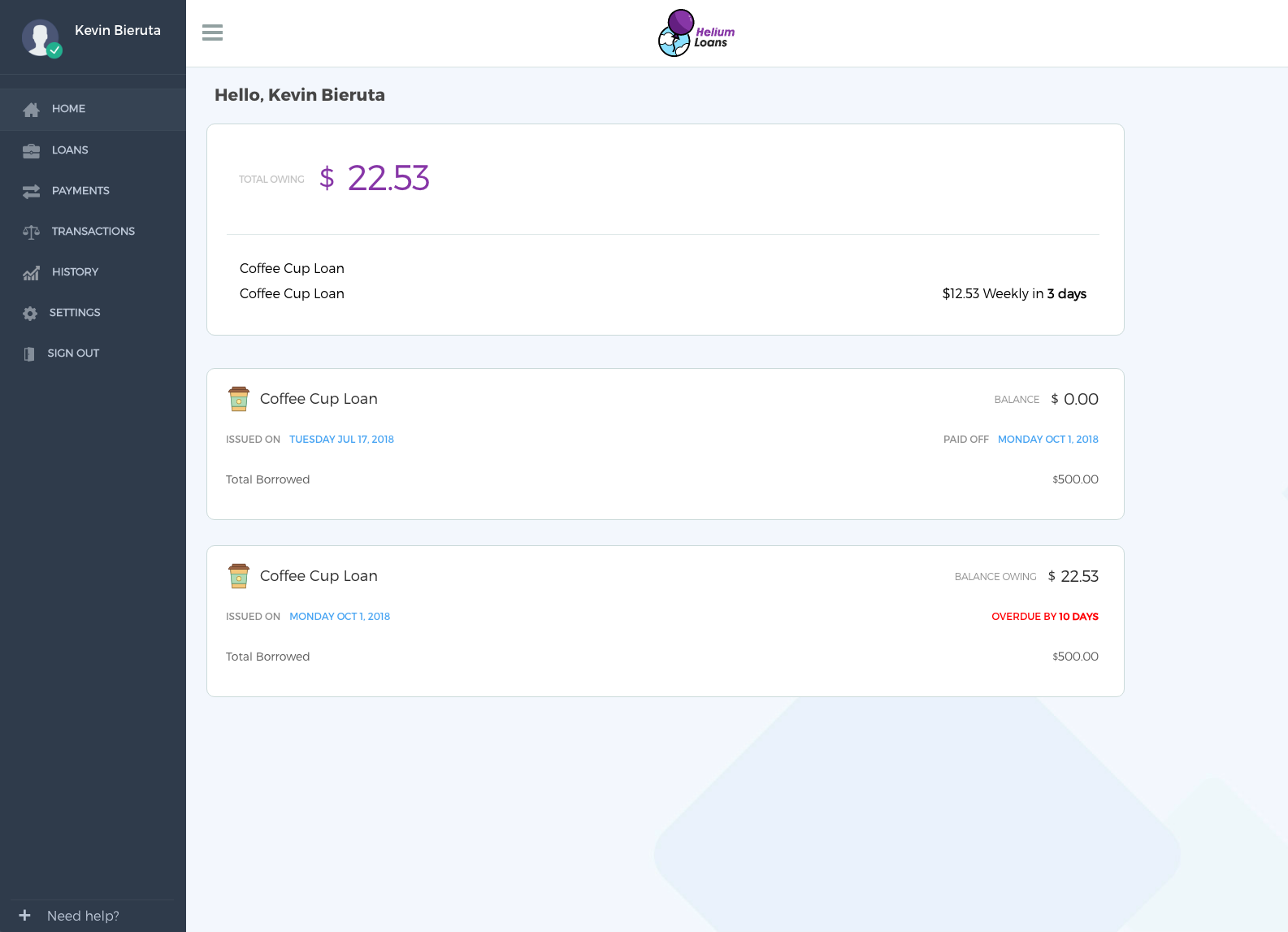

More for your clients

When your clients are looking for a feature rich experience that has their borrowing in mind - Helium Loans platform delivers. With more client features than any other lending platform it's simple why your clients will love the experience and keep on coming back.

When your clients are looking for a feature rich experience that has their borrowing in mind - Helium Loans platform delivers. With more client features than any other lending platform it's simple why your clients will love the experience and keep on coming back.

View loan products by type

View loan products by type

Get help online quickly and easily

Get help online quickly and easily

Estimate payments by term and frequency

Estimate payments by term and frequency

View and choose multiple products online

View and choose multiple products online

Borrow more after good payment history

Borrow more after good payment history

Change payment frequency, term and more

Change payment frequency, term and more

Re-apply for new borrowing products

Re-apply for new borrowing products

Delay payments 14 days quickly and easily

Delay payments 14 days quickly and easily

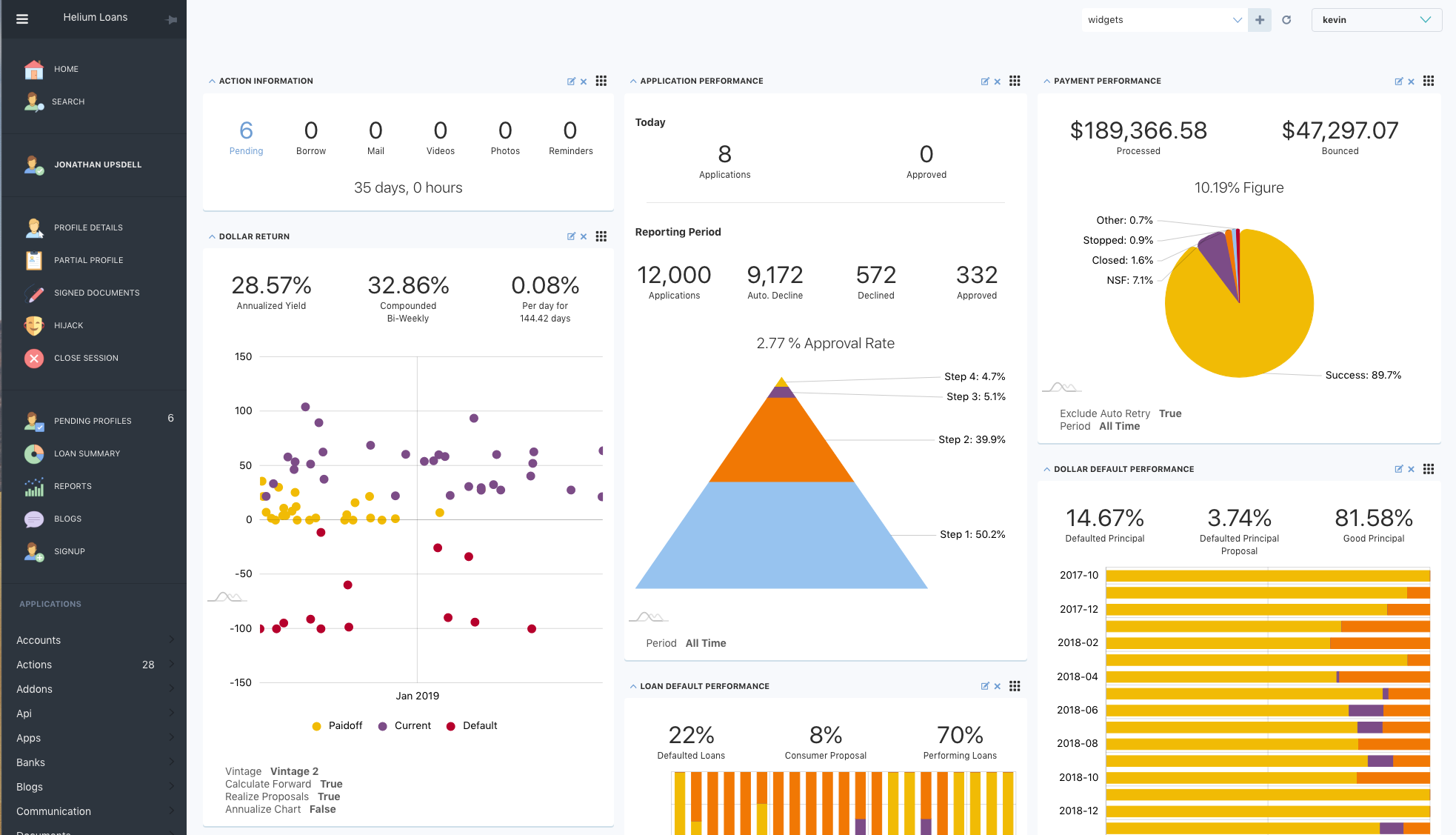

More for your lending business

We make it easy to on board your clients with different products. The signup process is already customized depending on what your clients are looking for and you can customize it further quickly and easily by extending the predefined templates. It's all built in and ready to go when you are.

We make it easy to on board your clients with different products. The signup process is already customized depending on what your clients are looking for and you can customize it further quickly and easily by extending the predefined templates. It's all built in and ready to go when you are.

KYC and AML compliant

KYC and AML compliant

View signed agreements with timestamp and IP Address

View signed agreements with timestamp and IP Address

Custom credit decisioning based on product & sub

Custom credit decisioning based on product & sub

Complete branding guidelines and documentation

Complete branding guidelines and documentation

Report loans in Metro2 format to Transunion and Equifax

Report loans in Metro2 format to Transunion and Equifax

Automatic late payment notifications

Automatic late payment notifications

Monetize with Google AdSense

Monetize with Google AdSense

Monetize declines with the Loan Connect partner network

Monetize declines with the Loan Connect partner network

Are you ready to become an lender with the best lending platform in the world?

How to get started

Simple Pricing

It's easy to get started with the world's best lending platform for Small and Medium Size Enterprises (SME's).

$3,000 Setup Fee

$2,500 Monthly Minimum

$90 / Hr Custom Development

$2 per Active Loan

* Identity, Banking and Credit Checks are billed per-applicant and are an extra charge

$2,500 Monthly Minimum

$90 / Hr Custom Development

$2 per Active Loan

* Identity, Banking and Credit Checks are billed per-applicant and are an extra charge

Estimate setup and integration time

Estimate setup and integration time Help you choose the right level of customization

Help you choose the right level of customization Information on pricing and getting started

Information on pricing and getting startedContact Us